EMS Data Team

Preparing Your Financial Institution for Salesforce Agentforce: 6 Steps for AI Readiness

We’ve reached a pivatol moment in the financial services industry with institutions facing rising customer expectations, increased regulatory scrutiny, and growing pressure to enhance operational efficiency. There is a powerful solution to these challenges that includes AI-driven automation that transforms workflows and elevates customer engagement. However, adopting such a transformative solution requires thoughtful preparation. Introducing Salesforce Agentforce. This guide explores what you need to know about Agentforce, how to prepare for its implementation, and how EMS Consulting can help you make the most of this cutting-edge technology.

What is Salesforce Agentforce?

Agentforce is Salesforce’s innovative AI platform that enables organizations to create and deploy intelligent agents customized for specific business needs.

That’s right. If you have a need, Agentforce has an agent.

These agents can automate tasks such as customer service interactions, sales development, and operational processes. Whether acting autonomously or assisting employees, Agentforce agents deliver efficiency, accuracy, and scalability.

With features like 24/7 omnichannel support, seamless integration with Salesforce tools, and enterprise-grade security, Agentforce combines the power of AI with human expertise. For financial institutions, the ability to handle tasks like KYC verification, loan processing, and compliance monitoring makes Agentforce a game-changer.

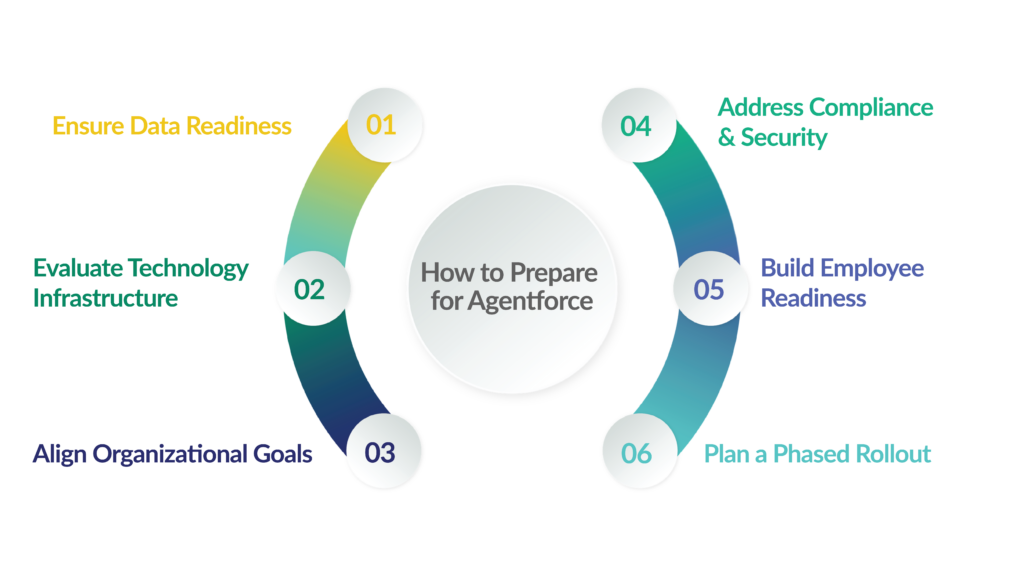

How to Prepare for Agentforce

This sounds great. But how do you prepare for such a robust operational change in your business? Adopting Agentforce successfully requires strategic planning and alignment across data, technology, people, and processes.

Step 1: Ensure Data Readiness

Agentforce relies heavily on accurate and organized data. Institutions should centralize customer, operational, and transactional data in a unified system like Salesforce Data Cloud or Snowflake. Data accuracy and completeness are essential to minimize errors during automation. Additionally, integrating legacy systems and external data sources through tools like MuleSoft ensures agents have access to all necessary information.

Step 2: Evaluate Technology Infrastructure

Agentforce requires compatibility with Salesforce Enterprise, Unlimited, or Einstein 1 Editions. Reviewing existing workflows, such as those built using Flows or Apex, can reveal areas where automation can be extended. Institutions should activate necessary AI capabilities like Einstein for Service, ensuring the platform is fully equipped to manage advanced use cases.

Step 3: Align Organizational Goals

Leadership buy-in is critical for a successful implementation. Institutions must define clear objectives, prioritize impactful use cases, and establish KPIs to measure success. For example, automating routine customer service tasks or accelerating loan processing can deliver quick wins that demonstrate the platform’s value. Cross-department collaboration, particularly between IT, compliance, and operations, ensures alignment and avoids operational silos.

Step 4: Address Compliance and Security

Compliance and security are foundational for any financial institution. Agentforce’s Trust Layer provides guardrails to ensure customer data is used securely and in compliance with regulations like GDPR or CCPA. Configuring agents to maintain audit trails and document actions further supports transparency and regulatory adherence. By building trust in the system, institutions can innovate without compromising their regulatory obligations.

Step 5: Build Employee Readiness

Training and change management are vital to help employees embrace Agentforce as a tool that enhances their capabilities. Provide role-specific training tailored to how employees will interact with the platform, whether by automating tasks or using assistive agents. Clear communication about how Agentforce can empower teams and streamline workflows is essential for building confidence and driving adoption.

Step 6: Plan a Phased Rollout

A phased rollout is often the best way to introduce Agentforce. Starting with a pilot focused on high-impact use cases allows organizations to test the platform, refine its functionality, and gather feedback before scaling up. Leveraging tools like Salesforce’s Agentforce Activator can help institutions launch agents quickly accelerating ROI and showcasing the platform’s value.

How EMS Consulting Can Help

As a trusted Salesforce partner with deep expertise in financial services, EMS Consulting is uniquely positioned to help your institution prepare and innovate. We guide organizations through every step of the process, from assessing data readiness and integrating systems to designing custom agents and training employees.

Our approach ensures that Agentforce aligns with your institution’s unique operational needs and regulatory requirements. Whether you’re looking to automate compliance checks, enhance customer service, or streamline back-office processes, EMS Consulting delivers tailored solutions that maximize ROI. Beyond implementation, we provide ongoing support to refine and expand your use of Agentforce, driving continuous improvements in efficiency, compliance, and customer satisfaction.

Take the Next Step with Agentforce

Salesforce Agentforce offers financial institutions a powerful way to modernize operations and deliver exceptional customer experiences. With the right preparation and a trusted partner like EMS Consulting, your organization can unlock the full potential of this transformative platform. Contact us today to learn how we can help you begin your Agentforce journey.