Salesforce for Mortgage Companies & Teams

Mortgage companies, banks, and credit unions around the world are choosing Salesforce as their customer relationship platform of choice because of its top-notch security, fully customizable customer service interface for lending and financial services teams, and its ability to integrate with other systems. EMS Consulting is a preferred Salesforce Partner in the financial services and mortgage lending spaces. We have helped hundreds of mortgage companies, banks, and credit unions implement their Salesforce tech stack and integrate with their other systems. Talk to our experts today about your mortgage experience transformation plans.

Meet Your New Salesforce Mortgage Tech Stack

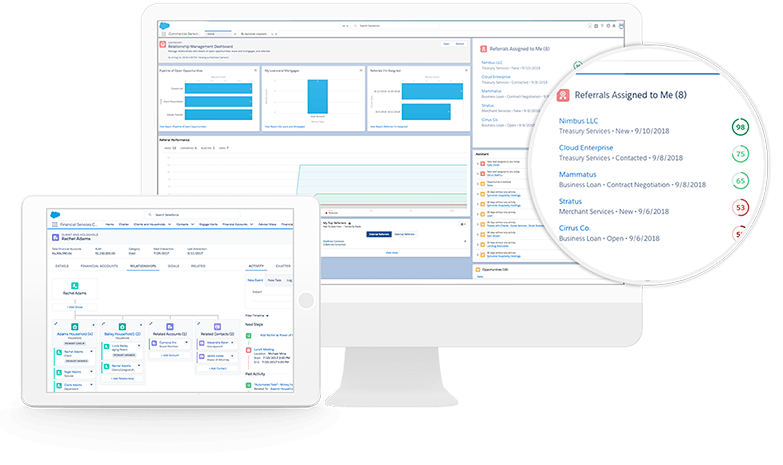

Salesforce Financial Services Cloud CRM

Salesforce Financial Services Cloud gives your frontline and contact center teams a seamless interface to build borrower relationships and manage customer service interactions with ease. Once your data is in Salesforce, it becomes reportable to management and leadership across the entire organization.

Integration with Mortgage Loan Origination Systems

Integrating your Mortgage loan origination system data with Salesforce lets your entire organization make use of your in-progress mortgage loan data directly in Salesforce. Your LOS is still a critical piece of your Mortgage tech stack, but Salesforce is built for accessibility across your entire organization. Letting the right data flow between these two systems can significantly improve your frontline teams’ abilities to assist borrowers during their mortgage loan process, without having to interface between multiple systems.

The EMS team regularly works with popular mortgage origination systems such as:

Using MuleSoft for Mortgage Companies, Banks, and Credit Unions

If your organization is looking to integrate multiple systems into Salesforce FSC, such as your mortgage loan origination system, core, consumer loan origination system, account origination system, and more… consider adding MuleSoft to the mix.

Leveraging Mulesoft as the integration layer between your legacy systems and Salesforce:

Salesforce Marketing Cloud for Mortgage Campaigns

Salesforce FSC and Marketing Cloud use a standard connector to synchronize data every 15 minutes, providing a near-time refresh of customer data. From there, Marketing Cloud can leverage that data for emails, journeys, and omni-channel interactions. Effortlessly bring your borrower data from Salesforce FSC to Salesforce Marketing Cloud where you can:

It’s Time To Transform Your Mortgage Business